milwaukee county wi sales tax rate

The 2018 United States Supreme Court decision in South Dakota v. The Wisconsin sales tax is a 5 tax imposed on the sales price of retailers who sell license lease or rent tangible personal property certain coins and stamps certain leased property affixed to realty or certain digital goods or sell license perform or furnish taxable services in Wisconsin.

The county use tax rate of 05 is imposed on purchasers of items used stored or consumed in counties that impose county tax.

. Verification and processing of claims takes four to eight weeks. The Milwaukee County Wisconsin Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Milwaukee County Wisconsin in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Milwaukee County Wisconsin. There was a 0 000 and a 5 000 increase.

Milwaukee County Property Records are real estate documents that contain information related to real property in Milwaukee County Wisconsin. The county sales tax rate of 05 is imposed on retailers making taxable retail sales licenses leases or rentals or providing taxable services in a Wisconsin county that has adopted the county tax. Wisconsin has a 5 percent sales tax.

1 State Sales tax is 500. 9th St Room 102 Milwaukee WI 53233-1462. Checks will be mailed to the address provided by the claimant in the unclaimed funds request form.

Sales Tax and Use Tax Rate of Zip Code 53226 is located in Milwaukee City Milwaukee County Wisconsin State. Taxes on local sales are between 5 and 10 percent. The Milwaukee County Wisconsin sales tax is 560 consisting of 500 Wisconsin state sales tax and 060 Milwaukee County local sales taxesThe local sales tax consists of a 050 county sales tax and a 010 special district sales tax used to fund transportation districts local attractions etc.

In a 5-2 decision on Friday the Wisconsin Supreme Court ruled that Brown Countys 05 sales tax is legal. A county-wide sales tax rate of 05 is. 53203 zip code sales tax and use tax rate Milwaukee Milwaukee County Wisconsin.

Estimated Combined Tax Rate 550 Estimated County Tax Rate 050 Estimated City Tax Rate 000 Estimated Special Tax Rate. Sales Tax and Use Tax Rate of Zip Code 53203 is located in Milwaukee City Milwaukee County Wisconsin State. The Milwaukee County sales tax rate is 05.

4 rows The current total local sales tax rate in Milwaukee WI is 5500. The Wisconsin state sales tax rate is currently. What is the sales tax rate.

For assistance please call the MHD COVID Hotline 1-414-286-6800. Has impacted many state nexus laws and sales tax collection requirements. Our dataset includes all local sales tax jurisdictions in Wisconsin at state county city and district levels.

The December 2020 total local sales tax rate was 5600. The Treasurers office will contact the claimants to inform them when their claim is completed. 6 rows The Milwaukee County Wisconsin sales tax is 560 consisting of 500 Wisconsin state.

The Milwaukee County sales tax rate is. Milwaukee County in Wisconsin has a tax rate of 56 for 2022 this includes the Wisconsin Sales Tax Rate of 5 and Local Sales Tax Rates in Milwaukee County totaling 06. Milwaukee Health Department Coronavirus COVID-19 updates.

The tax data is broken down by zip code and additional locality information location population etc is also included. Milwaukee County is home to over 950000 people living in one of 19 communities which range in size from the City of Milwaukee with 595000 residents to the Village of River Hills with roughly 1600 residents. 13 rows The Milwaukee County Sales Tax is 05.

Looking only since 2009 an analysis by Milwaukee County shows its residents paid 500 million more each year in income and sales taxes to. Milwaukee County Treasurers Office 901 N. To review the rules in Wisconsin visit our state-by-state guide.

How does sales tax work in Wisconsin. You can find more tax rates and allowances for Milwaukee County and Wisconsin in the 2022 Wisconsin Tax Tables. The state use tax rate is 5 and if the item purchased is used stored or consumed in a county that imposes county tax you must also pay an additional 05 county tax.

A sample of the 882 Wisconsin state sales tax rates in our database is provided below. WI Sales Tax Rate. The December 2020 total.

Estimated Combined Tax Rate 550 Estimated County Tax Rate 050 Estimated City Tax Rate 000 Estimated Special Tax Rate. Foreclosed Properties for Sale. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

53226 zip code sales tax and use tax rate Milwaukee Milwaukee County Wisconsin. The current total local sales tax rate in Milwaukee County WI is 5500. The 55 sales tax rate in Milwaukee consists of 5 Wisconsin state sales tax and 05.

3 State Sales tax is 500. A challenge to the tax had been brought by a local organization the Brown County.

Which Cities And States Have The Highest Sales Tax Rates Taxjar

Sales Taxes In The United States Wikiwand

Wisconsin Sales Tax Small Business Guide Truic

State Budget Significantly Improves Wisconsin S Tax Climate Wmc Wisconsin S Chamber

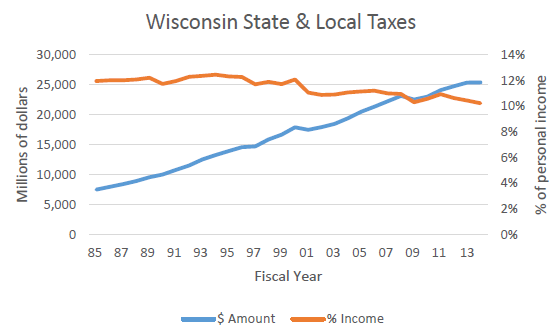

Revenue Wisconsin Budget Project

Revenue Wisconsin Budget Project

Revenue Wisconsin Budget Project

Wisconsin Sales Use Tax Guide Avalara

Wisconsin Sales Tax Rates By City County 2022

Revenue Wisconsin Budget Project

Sales Tax By State Is Saas Taxable Taxjar

Sales Taxes In The United States Wikiwand

Wisconsin Sales Tax Guide And Calculator 2022 Taxjar

Data Wonk Wisconsin Taxes And Inequality Urban Milwaukee

North Central Illinois Economic Development Corporation Property Taxes